We have loan officers in your community that thrive on helping you find the right mortgage to fit your needs.

Explore various loan program options for fixed and adjustable rate mortgages.

Our mortgage calculators help you hone in on your future mortgage based on options, interest rates, and more.

Get started with our secure application. It's a few quick questions that take about 12 minutes to complete.

At New American Lending, we understand that securing the right mortgage is a pivotal step in your journey towards homeownership. As a dedicated mortgage broker, we offer a diverse range of loan solutions tailored to meet the unique needs of our clients. Whether you are a first-time homebuyer or looking to refinance an existing mortgage, we are here to guide you every step of the way. Our team of experienced professionals is committed to helping you find the best mortgage options available, including FHA Loans, VA Loans, USDA Loans, and more. With our focus on customer satisfaction and Low Mortgage Rates, we ensure that you can achieve your financial goals without any hassle.

In addition to our wide array of loan products, New American Lending also offers various refinance programs designed to make the process seamless for our clients. If you're looking to take advantage of the current market conditions, you might consider our FHA Streamline or VA Streamline options, which can help lower your monthly payments and simplify the refinancing process. Our team is well-versed in the nuances of each program and will work closely with you to find the optimal solution that fits your financial situation. We pride ourselves on offering competitive rates and personalized service to ensure you enjoy the benefits of Low Mortgage Rates.

We also understand that every client has unique circumstances, which is why New American Lending provides a range of additional products and programs to suit various needs. From Down Payment Assistance for first-time homebuyers to specialized loans for self-employed individuals, we have the expertise to guide you through every option available. Our innovative loan products, including Bank Statement Loans and Investor Loans, are designed to cater to a diverse clientele. With New American Lending, you can rest assured that we will find the perfect loan solution that meets your specific requirements while maintaining Low Mortgage Rates.

Los Angeles is one of the most iconic cities in the world, known for its vibrant culture and diverse neighborhoods. At New American Lending, we are proud to serve the residents of Los Angeles by providing tailored mortgage solutions that help them achieve their dreams of homeownership. Whether you are looking for a cozy apartment in Hollywood or a spacious family home in the Valley, our team is here to assist you in navigating the competitive Los Angeles real estate market. With our comprehensive range of loan products and Low Mortgage Rates, we strive to make the process as smooth and efficient as possible for our clients.

Orange County, with its stunning beaches and family-friendly communities, is another focal point for New American Lending. We recognize the importance of finding the right mortgage for your dream home in this beautiful area. Our knowledgeable team is dedicated to helping Orange County residents access a variety of loan options, from Conventional Loans to Jumbo Loans, ensuring that you find the best fit for your financial situation. With the added advantage of Low Mortgage Rates, we aim to empower you to make informed decisions as you embark on your homeownership journey in Orange County.

San Francisco, a city known for its stunning scenery and tech-driven economy, is also served by New American Lending. We understand the unique challenges that come with buying a home in this competitive market, and we are committed to providing our clients with the support they need. From FHA Loans to Reverse Mortgages, our diverse portfolio of loan options is designed to cater to the needs of San Francisco residents. Our team will work diligently to secure Low Mortgage Rates that help you reach your financial goals, all while ensuring that you feel confident and informed throughout the process. With New American Lending, you can find the perfect mortgage solution for your San Francisco dream home.

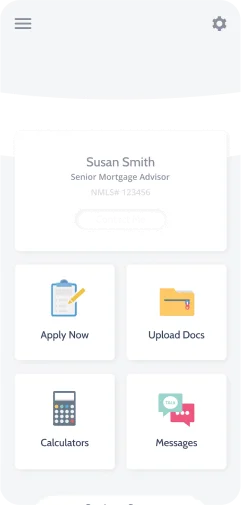

The Loanzify App guides you through your mortgage financing and connects you directly to your loan officer and realtor.

1201 Larrabee St #105

West Hollywood, CA 90069

Phone: (949) 259-3200

sam@sampabuwal.com